This week’s highlights: A Golden Age of Fraud

Happy Friday everyone –

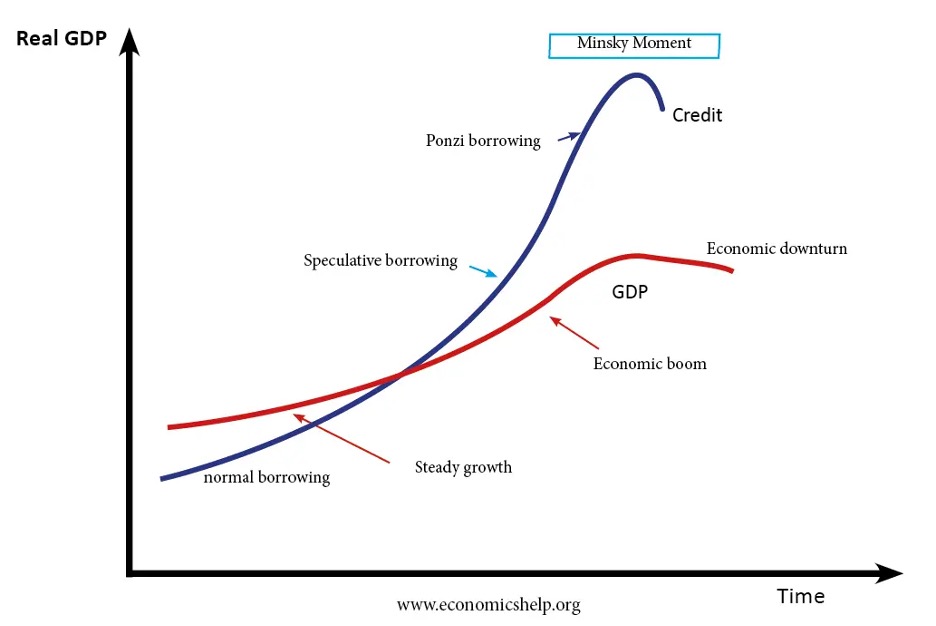

Our topic of the week is fraud! In fortunate timing, I had already been chewing on this topic even before this week’s FTX fiasco. Now it feels even more apropos. Above you will find a version of the Minsky curve and Minsky moment. Economist Hyman Minsky studied financial market cycles and is famous for his Financial Instability hypothesis, namely that the risk taking of capitalism encourages the bad behavior that brings a cycle to its end.

Minsky’s name only surfaces every 10 years or so – most recently during the global financial crisis in 2008 and 2009. But it’s a timely framework to keep in mind. Our current cycle has seen some wonderful frauds that as an innocent bystander make for great spectating – but real hardship for those lured in.

Cheers,

David

Topic of the Week

- Bloomberg – FTX Is Still Looking for Money. The obvious question — here and always — is: Is it a liquidity problem, or a solvency problem?

- WSJ – Bad Bets Podcast – Credit Matt L – Season 2 of the Bad Bets podcast unpacks the story of Trevor Milton. Milton, founded the electric truck start-up, Nikola Motors. He was convicted of fraud in October of 2022. Amongst his most notorious acts was rolling a non-working truck down a long hill in Utah to film a promo video of the truck’s performance.

- Vanity Fair – Inside Wealth-Conference Con Man Anthony Ritossa’s Wild Web of Lies. A VF investigation reveals that a self-styled knight and purported Nobel Prize nominee is actually a Wall Street washout, a deadbeat dad, and a con artist, repeatedly jailed by European authorities.

- BusinessWeek – A Chinese Spy Wanted GE’s Secrets, But the US Got China’s Instead. How the arrest of a burned-out intelligence officer exposed an economic-espionage machine.

- Vanity Fair – COVID-19 Origins: Investigating a “Complex and Grave Situation” Inside a Wuhan Lab. The Wuhan Institute of Virology, the cutting-edge biotech facility at the center of swirling suspicions about the pandemic’s onset, was far more troubled than previously known, explosive documents unearthed by a Senate research team reveal. Following the trail of evidence, Vanity Fair and ProPublica provide the clearest picture yet of a laboratory institute in crisis.

- For your weekend viewing –

- Wizard of Lies. The fall of Bernie Madoff, whose Ponzi scheme robbed $65 billion from unsuspecting victims; the largest fraud in U.S. history.

- The Dropout – TV series that chronicles Theranos founder Elizabeth Holmes’ attempt to revolutionize the healthcare industry after dropping out of college and starting a technology company.

- Fyre Fraud – Concert promoters and rapper Ja Rule advertise a high-end festival experience that fails spectacularly when they don’t plan for the infrastructure to support the venue, artists and guests.

- The Big Short – In 2006-2007 a group of investors bet against the US mortgage market. In their research, they discover how flawed and corrupt the market is.

Other Great Reads

- WSJ – More Colleges Offering Admission to Students Who Never Applied. Direct admissions allow colleges to send offers to students based just on GPAs or a few other criteria

- a16z – Why Technology Still Matters with Marc Andreessen. Together with Marc, this episode explores technology through the lens of history – including the three stages of human psychology as we encounter new technologies, how that process often manifests in regulation, when to change your mind, the Cambrian explosion of opportunity coming from distributed work, the importance of founder-led companies, and perhaps most importantly, we examine why there’s still much reason for optimism.

- NYP – Gen Z party poopers have ruined after-work drinks – Ah, maybe the lighting rod of young adult angst has finally been passed from millennials to Gen Z

- Quanta – Inside the Proton, the ‘Most Complicated Thing You Could Possibly Imagine’. The positively charged particle at the heart of the atom is an object of unspeakable complexity, one that changes its appearance depending on how it is probed. We’ve attempted to connect the proton’s many faces to form the most complete picture yet.

- CNN – The woman who travels the world with only a tiny bag

My Book:

When Anything is Possible – Wealth and the Art of Strategic Living

- Does how you handle your wealth actually align with what you care most about in the world?

- Do you feel like you are pro-active and intentional with your financial affairs or entirely reactive to a busy world?

Growing financial wealth is a natural occurrence on the path to success. While this should make life easier, that is not always the case. With greater wealth, comes great opportunity and an overwhelming number of choices to make.

When Anything is Possible is the guidebook about how to engage strategically with wealth. It will help you change your wealth from something overwhelming and all-consuming towards a resource to be deployed to help you positively impact the things that you value most.

If you are interested in learning more, visit here and download a free chapter.